Ruddock Report: Buckling Budgets Are Online Casino Legalization’s Best Friend

Particularly in Massachusetts, Illinois, and New York, an influx of money will be sorely needed

4 min

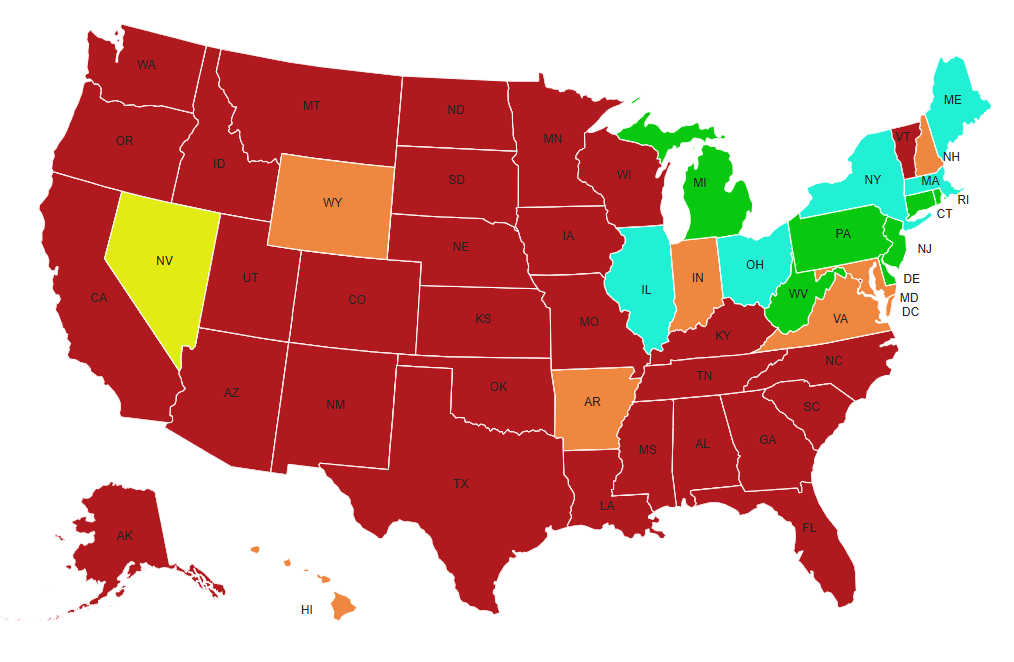

Our monthly look at the online gambling landscape includes the current legal and regulatory landscape, prospective online casino and online poker states, and significant trends to watch.

There’s not much optimism for online casino legalization in 2026, and for good reason. As I noted in last month’s Ruddock Report, “I’m leaning bearish for significant breakthroughs in 2026. The election cycle and coalescing opposition will likely keep iGaming as a topic of debate rather than result in legislative action.”

However, that bearish forecast came with a caveat: “If budget crunches hit hard, prediction markets erode state revenue, or a key state like New York flips, the dam could crack.”

In this month’s column, I’ll look at three states that are in desperate need of revenue: Massachusetts, Illinois, and New York.

It’s the economy, stupid, Part 1: Massachusetts

Massachusetts is strapped for cash (with a reported 21% spending surge since FY21 outpacing 2.2% revenue growth) to the point it has been dipping into the Community Mitigation Fund created in 2011, and first funded in 2015, to offset the community impact of casino gambling.

As the CommonWealth Beacon reported, “In the 2025 state budget, lawmakers allowed a temporary redirection of those gaming revenues — a move Gov. Maura Healey branded as a one-time maneuver to free up $100 million for state spending during a tight budget year. But the 2026 state budget saw the Legislature again redirect the funds to priorities like transportation, education, economic development, and tourism.”

These budget shortfalls are not going away, and with no new money coming in, the last of the CMF’s funds are expected to be awarded by 2027.

It’s the economy, stupid, Part 2: Illinois

Illinois is grappling with persistent budget challenges, including a projected shortfall in its fiscal year 2026 budget, which Gov. JB Pritzker outlined in February 2025 as requiring tough choices amid rising costs for education, healthcare, and public services. An October report indicates the “balanced” FY26 budget now faces a $267 million deficit.

Illinois (and even the city of Chicago) has been hammering its sportsbooks to make up for budget shortfalls, but the state has pretty much maxed out the juice it can squeeze from that industry. So, what’s left? Expansion. And the only expansion left is online casinos. Bills to introduce online casinos were discussed in 2025, with Pritzker signaling openness to including it in budget proposals, though opposition from existing casino operators and the VGT industry proved too big a hurdle.

It’s the economy, stupid, Part 3: New York

New York is constantly looking for revenue to balance its budget (New York could face a $34.3 billion cumulative gap through FY29) and cover the cost of massive projects, like Gov. Kathy Hochul’s transit agenda.

State Sen. Joseph Addabbo Jr., one of the state’s most vocal online casino advocates, has consistently pointed to online casinos being the solution to New York’s budget problems. Following the governor’s 2024 State of the State Address, Addabbo said:

“The governor did a fine job laying out the game plan about where she wants the state to go and what she wants the state to do. But, in that press conference and the executive budget, there’s no how to get these things accomplished or how to move forward.”

2025 online casino bills

The Ruddock Report will revise this list as new bills are introduced.

LEGAL ONLINE GAMBLING ONLINE POKER-ONLY

ACTIVE LEGISLATION LEGISLATIVE EFFORTS FAILED

Active bills

New York

- S 2614, sponsored by Sen. Joseph Addabbo Jr.

The bill was introduced on Jan. 21 and referred to the Racing, Gaming, and Wagering Committee. It has appeared on the legislative radar a couple of times. However, the bill has been overshadowed by the awarding of downstate casino licenses, leaving little legislative bandwidth for iCasino in 2025. It remains stalled in committee with no further action.

Ohio

- HB 298, sponsored by House Finance Committee Chair Brian Stewart

The bill received its first hearing in the Select Committee on Gaming shortly after its introduction, but no further progress has been reported.

- SB 197, sponsored by Sen. Nathan Manning

As of late August, it remained in the introductory phase with no reported committee action or passage, though broader discussions on regulated online casino gaming continue.

Massachusetts

- HD 2393 (now tracked as H 4431), sponsored by Rep. David Muradian

Filed as a docket on Jan. 16, and referred to the Committee on Economic Development and Emerging Technologies on Aug. 18. This is the latest effort, which aims to legalize online casinos while also prohibiting sweepstakes sites.

- HB 332, sponsored by Rep. Daniel Cahill

Introduced Feb. 27, with a hearing held on June 23, by the Joint Committee on Consumer Protection and Professional Licensure.

- SB 235, sponsored by Sen. Paul Feeney

Introduced Feb. 27 and discussed alongside HB 332 in the June hearing.

Illinois

- SB 1963, sponsored by Sen. Cristina Castro

Introduced Feb. 6, with first reading. The legislation proposes a 25% tax on internet gaming, which is likely a non-starter considering Illinois’ recent treatment of sportsbooks via the tax code.

- HB 3080, sponsored by Rep. Edgar González, Jr.

A companion bill to Sen. Castro’s Senate bill.

Illinois looks great on paper, but the problem is, (almost) no one wants to expand into online casinos except online casino companies, evidenced by nearly 1,000 witnesses testifying against online casinos at a recent hearing. March polling from Tulchin Research indicates opponents are winning the public perception battle, as respondents overwhelmingly view online gambling as a more addictive product that will lead to increased rates of problem and underage gambling.

Maine

- LD 1164, sponsored by Rep. Ambureen Rana

Passed by the House and Senate and on the desk of Gov. Janet Mills (who is expected to veto, or pocket veto, the bill when the legislature returns in 2026).

The legislation allows each of the state’s four tribes to offer online casino gambling: Houlton Band of Maliseet Indians, Mi’kmaq Nation, Passamaquoddy Tribe (with two reservations: Indian Township and Pleasant Point), and Penobscot Nation.

The bill calls for a $50,000 licensing fee and a 16% tax rate, with funds distributed as follows:

- 3%: Deposited in the Gambling Addiction Prevention and Treatment Fund

- 3%: Deposited in the E-9-1-1 fund

- 3%: Deposited in the Opioid Use Disorder Prevention and Treatment Fund

- 2%: Deposited in the Emergency Housing Relief Fund

- 3%: Deposited in the Maine Veterans’ Homes Stabilization Fund

Inactive bills:

New Hampshire

- SB 168, sponsored by Sen. Tim Lang

Arkansas

- HB1861, sponsored by Rep. Matt Duffield

Maryland

Virginia

Wyoming

- HB 162, sponsored by Rep. Bob Davis

Indiana

- HB 1432, sponsored by Rep. Ethan Manning