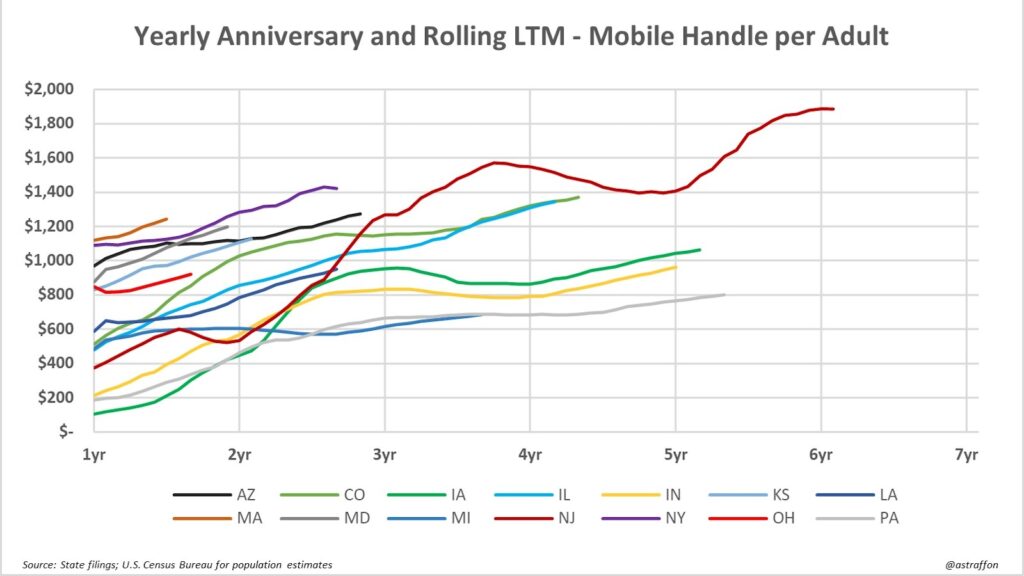

Chart Illustrates Drastic Shift In Way Sports Betting Markets Ramp Up Post-Launch

These days, there’s far less of a period of gradual build

2 min

In the early days post-PASPA when the first wave of states authorized sportsbooks to go online after soft-launch periods, the hours around takeoff within the offices of industry stakeholders were marked by a combination of excitement and anxiety.

That’s probably still the case in the more recent wave of states implementing a regulated sports betting market, but the operators who remain have shaped playbooks for launching and getting up to speed.

And it’s in that ramp up where an interesting shift has occurred, which is the thrust of this illustration. For this chart produced by Alfonso Straffon (more of the former equities analyst’s work can be found here and here), the Y axis reflects mobile handle per year per adult on a rolling twelve month basis.

Take a look at how the ramps have changed, as indicated in these more recent launches:

- New York (January 2022 launch online)

- Maryland (November 2022)

- Kansas (September 2022)

- Ohio (January 2023)

- Massachusetts (March 2023)

Compare those to some of the more vintage launches:

- New Jersey (August 2018)

- Pennsylvania (May 2019)

- Illinois (March 2020)

- Colorado (May 2020)

- Michigan (January 2021)

- Arizona (Sept. 2021)

The main point is that of-age bettors are spending more on average at the outset, rather than an increase in spend occurring over a sustained period of usage, adoption, and advertising.

A major shift driving this, which DraftKings CEO Jason Robins has noted, is that DraftKings (and some peers) have adopted a more national-minded media spend as part of their core marketing strategy.

In the past two years, versus 2018-2020, sports betting is more deeply steeped into the national dialogue, conversation, and consciousness, for better and/or worse.

As Robins noted during a May 2023 earnings call:

We’ve very much optimized our go-to-market. We now are close to two dozen states at this point. So I think we’ve had a lot of time to really optimize that and feel very good about our new state playbook.

Secondly, you’re seeing the effects of national advertising and that really, I think, especially in the case of Ohio, Massachusetts, and Maryland, which came late or shortly following in the case of Massachusetts, the NFL season, a lot of that, probably a quick ramp was at least in part the result of a switch to national advertising, which made it more — that these states that in the past maybe for a new state launch hadn’t seen as much of the advertising during an NFL season. Ohio and Maryland and Massachusetts saw advertising on our national advertising all year — all NFL season long.

I think also there’s a lot of momentum in the industry. People travel to different states. They have friends playing. So I think that’s helped with faster ramp. And I do think that competitively you’re right, that there’s been a lot more consolidation in the last few state launches to the top two players in the sportsbook market. And I think that, that’s also driving it as well.

The interesting part now? Tracking where all of these states will land relative to New Jersey in Year 6 or so post-launch. Stay tuned.