Sweeps, Prediction Markets Collide: MyPrize Will Offer Access To Crypto.com Contracts

MyPrize says it will be first to offer social gaming and prediction markets ‘in one unified platform’

3 min

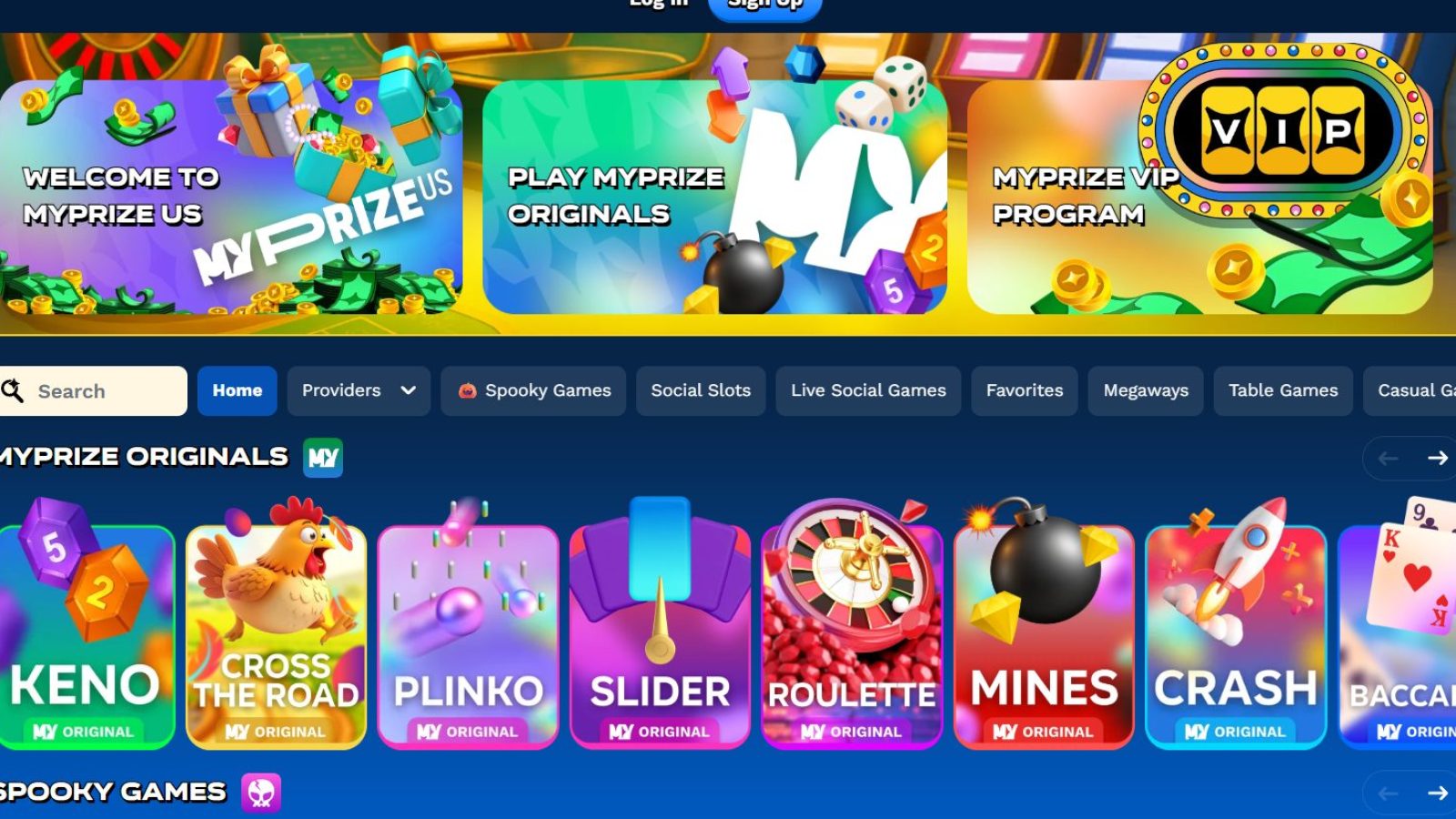

The worlds of sweepstakes casinos and prediction markets are overlapping as sweeps-based casino MyPrize will offer access to Crypto.com’s prediction markets on its platform.

Per a press release published Tuesday, MyPrize will launch MyPrize Markets, which it says will make the operator the first to offer social gaming and prediction markets “in one unified platform.”

MyPrize founder and CEO Zach Bruch said the partnership will include bets on sports, as well as contracts related to cryptocurrency and other non-sports markets.

The press release did not offer a launch timeline but said the offering would be available in the U.S. and internationally. MyPrize launched an international site in September.

“We are excited to partner with Crypto.com to launch all new prediction market products like sports, events, crypto, and more to our million users in the U.S. and abroad,” he said in the release. “Together we will lean in and deliver fun and engaging experiences for our players and bring major enhancements to the social, livestreaming content, and community engagement that the MyPrize platform fosters.

“After exploring the market, it quickly became obvious to us that Crypto.com has by far the market leading infrastructure for institutional and enterprise scale. Together we will be able to deliver this first-of-its-kind product offering to all of MyPrize’s users and onboard our billions in volume into the MyPrize Markets product.”

The press release called the tie-up a “strategic partnership” and did not reveal the regulatory status of MyPrize. It is likely that MyPrize will be a technical service provider to Crypto.com, similar to daily fantasy sports company Underdog’s status, rather than having any formal status of its own with the Commodity Futures Trading Commission (CFTC).

Crypto.com also announced a deal with Trump Media and Technology Group last week, which again appears to be officially acting as a technical service provider to Crypto.com.

Crypto.com Managing Director and Global Head of Capital Markets Travis McGhee said the deal would help bring volume to his company’s prediction market offering, leading to more liquid markets.

“We are seeing a massive change in how financial markets are converging with other products,” McGhee said. “We have been at the forefront of the convergence of crypto with TradFi. Now, we are at the forefront of a similar convergence with live social platforms and financial markets with our partner, MyPrize. Together, we are positioned to grow, innovate, and be the leader in prediction market products, which allow information discovery of what matters to retail users.

“This next generation of financial markets will require velocity and scale, qualities that Zach and his team at MyPrize have – they bring best-in-class experiences to their user base and billions in volume to Crypto.com. This partnership will make MyPrize the first integrated app allowing users to access markets, gaming, livestreaming, and social all in one application, which will level-up prediction markets for the first time.”

Debates on legality of sweeps, predictions

Both sweepstakes and prediction markets have been subject to debates over their legality. Like most sweepstakes casinos, MyPrize uses two virtual currencies, which it calls “gold coins” and “sweeps cash.” Sweeps cash can be redeemed for real cash, whereas gold coins cannot.

Users can buy gold coins with cash, and every gold coin purchase also includes sweeps cash as a “freebie.” Sweeps cash can also be obtained for free via a “daily reload” or by playing enough games to “level up.”

Not all regulators see this as a legal method of doing business, and opponents such as the American Gaming Association argue that the dual-currency system is effectively a loophole to allow real-money gaming in states where it’s not legal.

California passed legislation to ban sweepstakes casinos last month, while states including Louisiana, Mississippi, and Michigan have sent cease-and-desists to sweepstakes operators.

Prediction markets allow customers to bet on a range of events, including both sports and non-sporting events like elections, in an exchange format. Users can buy or sell “contracts” that will pay out if an event occurs.

These contracts are officially considered “swaps,” a form of financial instrument typically used for hedging risk and regulated by the CFTC, which is also responsible for instruments like oil and grain futures.

State regulators have challenged this business model, too, arguing that contracts on sports violate state gambling laws. Prediction markets have argued that only the CFTC has the jurisdiction over the contracts listed by exchanges.

On Monday, Crypto.com stopped allowing users in Nevada to access its sports contracts after a court ruled that its contracts are not swaps and therefore are still subject to state gambling laws. It was the first time an exchange was forced to stop offering sports contracts within a state.