BetMGM Reports Record Fiscal Year 2025

While online sports betting powered growth, iGaming gains encourage CEO Adam Greenblatt

2 min

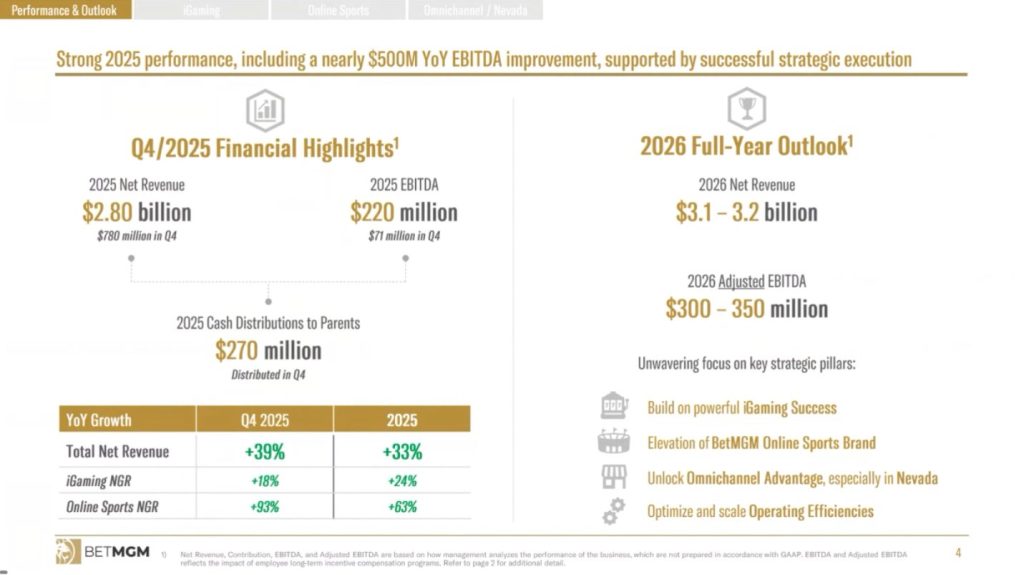

BetMGM CEO Adam Greenblatt said in a fiscal year 2025 performance report to investors on Wednesday that the company still considers itself iGaming-focused. But it was a 63% year-over-year online sports revenue increase that allowed the company to post a record net revenue of $2.8 billion, a 33% jump from 2024.

“Both online sports and iGaming generated significant contributions, over $200 million and $500 million respectively,” Greenblatt said. “Moreover, our stronger-than-expected results allowed for the actual distribution to be $270 million, compared to our guidance of at least $200 million. We are very proud of this achievement, as it clearly demonstrates that BetMGM has sharply turned the corner into our next phase of growth.”

BetMGM’s iGaming net revenue increased by 24% in 2025, after going up 13% in 2024. This powered an EBITDA of $220 million, which beat the company’s revised guidance from Q3.

BetMGM returned $270 million to its parent companies, according to a release.

Record player engagement in December was credited for a Q4 online sports net revenue increase of 93% from the same period in 2024.

Greenblatt cites innovations

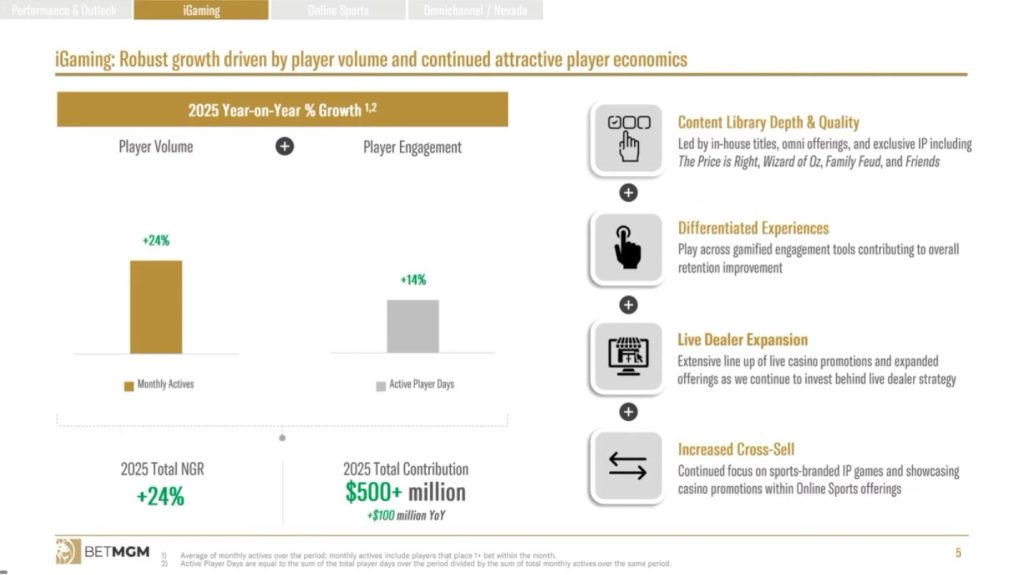

BetMGM acknowledged “improved player management driving acquisition and retention” for a steady growth in iGaming, where average monthly active users increased by 24% year over year.

Greenblatt credited new online games such as Wizard of Oz, The Price Is Right, and Friends; a refined live dealer strategy — Greenblatt claimed that BetMGM is the fastest-growing provider in the United States; and a cross-promotion initiative that funneled sports bettors to iGaming. Greenblatt said that during the most recent NFL season, around 60% of BetMGM’s online sports bettors were also playing online casino.

Other BetMGM data points:

- Online sports betting produced a record $279 million in net revenue, nearly doubling 2024

- Overall active player base increased by 6%

- These players placed an average of 12% more bets

- Average player handle increased 26%

Inside BetMGM iGaming figures

“Fourth quarter iGaming revenue was up 18 percent over last year, with full year up 24 percent year-on-year, delivering $1.8 billion of net revenue and over $500 million in contributions,” Greenblatt said. “Our iGaming business continues to scale to record heights, with the underlying story consistent with our overall plan.

“You may remember from our last update, I think it was last summer, we expected the pace of growth later in the year to moderate, and it has, but by less than our expectations.”

Greenblatt said that BetMGM continues to invest in being the “gaming destination for all iGaming players,” with a library of 7,000 titles that increased by more than 1,500 in FY 2025.

Greenblatt was pleased with the iGaming success given that just seven states have markets underway. Maine, which legalized online casino in January, will eventually become the first state to launch a market since 2024.

“The natural question is what is the potential for these markets that have been active and focused on marketing for a number of years now?” Greenblatt said. “I keep saying that we remain surprised by the depth of New Jersey, [which] has been active for more than 10 years. So I believe in our existing states, we still have some ways to go.

“We have a number of jackpot products coming, should be coming in the next few weeks actually. Excited about jackpots to be precise. The other area which we’ve mentioned is our investment in live and the post-market growth we’re achieving, but also the advantage that we have with MGM resources to create differentiated live offerings which our players are enjoying.”

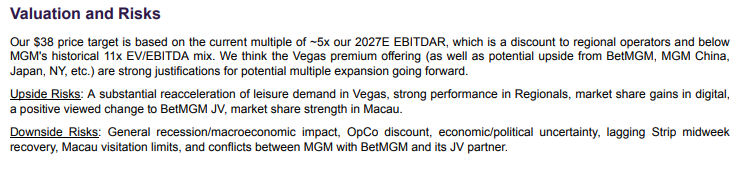

Truist analysts noted that MGM Resorts stock was “outperforming” at $34.17. It set a price target for the stock at $38.

BetMGM, which is owned through a split venture with MGM Resorts International and Entain plc, projected 2026 revenue of around $3.1 billion and adjusted EBITDA around $300 million.