Ruddock Report: Can Prediction Markets Accelerate Online Casino Legalization?

We have entered a new ‘speculative tailwind potential’ phase of iCasino expansion

5 min

Our monthly look at the online gambling landscape includes the current legal and regulatory landscape, prospective online casino and online poker states, and significant trends to watch.

All eyes are on prediction markets. Sports betting operators are trying to hold them back at the gate, so far unsuccessfully, as platforms like Kalshi continue to expand nationwide, even in states where sports betting remains prohibited.

Regulated by the Commodity Futures Trading Commission (CFTC), prediction markets argue they are outside the purview of state regulatory bodies. And they are surging in popularity, offering a legal alternative in jurisdictions where sports betting is not permitted.

Online casinos appear to be insulated from prediction markets — but that may not actually be the case.

Prediction-style casinos coming?

According to Eilers & Krejcik Gaming, Kalshi is kicking the tires around a casino-like prediction market. “Unconfirmed but growing chatter suggests Kalshi may be exploring a prediction markets (PM)-based casino-like product,” EKG reports. “The contours of a PM casino-ified product are unclear, and potential reactions from regulators, courts, and Congress even murkier. … Still, there is some speculative tailwind potential.”

This speculation isn’t isolated. Social media discussions highlight a growing interest in prediction markets as a “new casino type,” with users pondering applications such as betting on roulette outcomes or integrating them into broader gambling ecosystems.

That possibility has legalization supporters reframing their “it’s already available” talking points, shifting from references to unregulated offshore markets and sweepstakes casinos to federally sanctioned prediction platforms. This pivot underscores how Americans in non-gambling states can already engage in similar activities, potentially pressuring lawmakers to regulate and tax online casinos for revenue generation.

Operators like Rush Street Interactive (RSI) have already highlighted the threat posed by prediction markets, arguing that their presence normalizes digital wagering and could accelerate legalization in holdout states like New York or Illinois. CEO Richard Schwartz said on the company’s earnings call in August that if prediction markets gain hold and start eroding tax dollars from states, there is a “very real possibility” it will accelerate the legalization of iCasino: “I think it could work out well for us ultimately in the sense that our top priority is legalizing more additional iCasino states and opportunities for online casino legalization.”

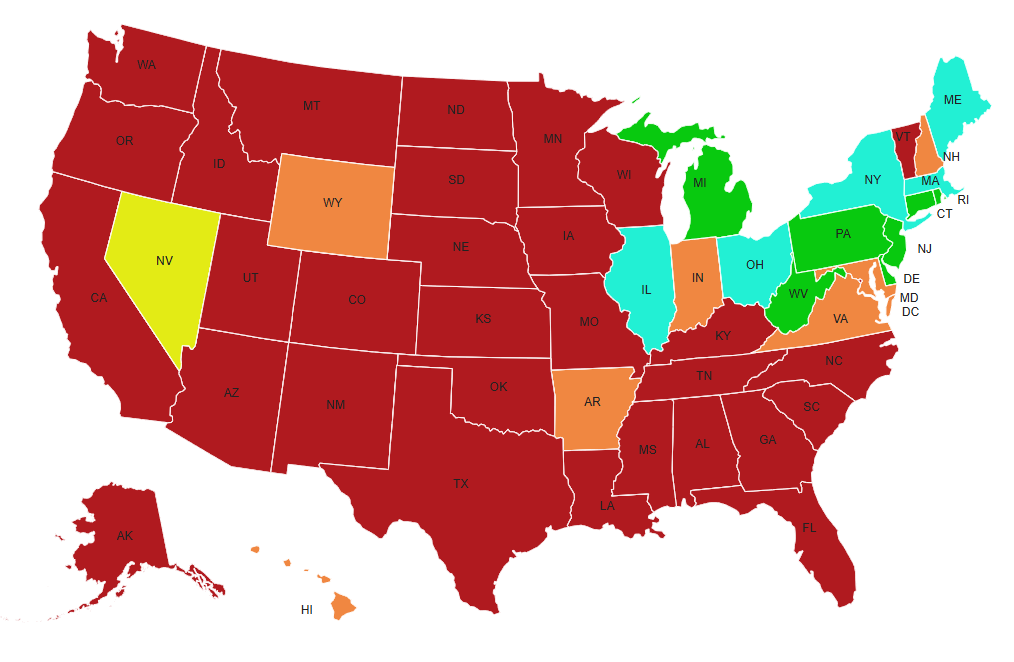

2025 online casino bills

The Ruddock Report will revise this list as new bills are introduced.

LEGAL ONLINE GAMBLING ONLINE POKER-ONLY

ACTIVE LEGISLATION LEGISLATIVE EFFORTS FAILED

Active bills

New York

- S 2614, sponsored by Sen. Joseph Addabbo Jr.

New York is the month’s spotlight state. Addabbo’s bill was introduced on Jan. 21 and referred to the Racing, Gaming, and Wagering Committee. It has appeared on the legislative radar a couple of times. However, the bill has been overshadowed by the awarding of downstate casino licenses, leaving little legislative bandwidth for iCasino in 2025. It remains stalled in committee with no further action.

Can land-based casino licenses spur online legalization? That’s a question Casino Reports writer Chris Altruda asked during an appearance on my podcast:

“Now, let’s say the license process goes through, and they only issue the two. They keep the third. Do you not think that on Jan. 1, Joe Addabbo is going to walk into Albany and just throw down his online gaming bill and say, ‘Look, we did the casino process. You guys had your fun. You got your billion dollars. Here’s where we’re filling in the gap. We’re going to tax online casinos at 30 percent’ — which is going to come across as reasonable because of the 51 percent on mobile betting — ‘and you’re going to fill that void.’

“In those five years, the third licensee was going to build its casino. You’re arguably going to get more money overall from online gaming than you would have in that five-year gap to when the first bet was going to be taken by Hard Rock or Bally’s.”

Ohio

- HB 298, sponsored by House Finance Committee Chair Brian Stewart

The bill received its first hearing in the Select Committee on Gaming shortly after its introduction, but no further progress has been reported.

- SB 197, sponsored by Sen. Nathan Manning

As of late August, it remained in the introductory phase with no reported committee action or passage, though broader discussions on regulated online casino gaming continue.

Massachusetts

- HD 2393 (now tracked as H 4431), sponsored by Rep. David Muradian

Filed as a docket on Jan. 16 and referred to the Committee on Economic Development and Emerging Technologies on Aug. 18, this is the latest effort, which aims to legalize online casinos while also prohibiting sweepstakes sites.

- HB 332, sponsored by Rep. Daniel Cahill

Introduced Feb. 27, with a hearing held on June 23 by the Joint Committee on Consumer Protection and Professional Licensure.

- SB 235, sponsored by Sen. Paul Feeney

Introduced Feb. 27 and discussed alongside HB 332 in the June hearing.

Illinois

- SB 1963, sponsored by Sen. Cristina Castro

Introduced Feb. 6 with first reading. The legislation proposes a 25% tax on internet gaming, which is likely a non-starter considering Illinois’ recent treatment of sportsbooks via the tax code.

- HB 3080, sponsored by Rep. Edgar González, Jr.

A companion bill to Sen. Castro’s Senate bill.

Illinois looks great on paper, but the problem is (almost) no one wants to expand into online casinos except online casino companies, evidenced by nearly 1,000 witnesses testifying against online casinos at a recent hearing. March polling from Tulchin Research indicates opponents are winning the public perception battle, as respondents overwhelmingly view online casino as a more addictive product that will lead to increased rates of problem and underage gambling.

Maine

- LD 1164, sponsored by Rep. Ambureen Rana

Passed by the House and Senate and on the desk of Gov. Janet Mills (who is expected to veto, or pocket veto, the bill when the legislature returns in 2026), the legislation allows each of the state’s four tribes to offer online casino gambling: Houlton Band of Maliseet Indians, Mi’kmaq Nation, Passamaquoddy Tribe (with two reservations: Indian Township and Pleasant Point), and Penobscot Nation.

The bill calls for a $50,000 licensing fee and a 16% tax rate, with funds distributed as follows:

- 3%: Deposited in the Gambling Addiction Prevention and Treatment Fund

- 3%: Deposited in the E-9-1-1 fund

- 3%: Deposited in the Opioid Use Disorder Prevention and Treatment Fund

- 2%: Deposited in the Emergency Housing Relief Fund

- 3%: Deposited in the Maine Veterans’ Homes Stabilization Fund

Inactive bills

New Hampshire

- SB 168, sponsored by Sen. Tim Lang

Despite passing the committee stage, Lang “tabled” the bill due to opposition. It can be brought back later in the session, but nothing on the ground has changed that would indicate progress is happening behind the scenes.

Arkansas

- HB1861, sponsored by Rep. Matt Duffield

A late push came up short in Arkansas, as Rep. Duffield’s legislation was withdrawn and recommended for interim study by the House Judiciary Committee. The bill emerged late in the session (which seems to be the best way to pass a gambling expansion bill these days), but the stakeholder divide between Saracen Casino (pro) and Oaklawn (against) was too large to overcome.

Maryland

Legislation once again stalled in committee, and the absence of online casino revenue in the state’s proposed budget deal between the legislature and Gov. Wes Moore signaled the end of 2025 efforts.

Virginia

A new contender in the online casino landscape, Virginia ran into similar concerns from unions and brick-and-mortar stakeholders that have plagued states like Maryland and New York. The proposed legislation failed to gain traction in either chamber, with sponsors pulling the bills and announcing they will reintroduce them in 2026.

Wyoming

- HB 162, sponsored by Rep. Bob Davis

Efforts to legalize online casinos in Wyoming failed to gain the necessary support from the committee and are effectively dead. Despite a favorable report from Spectrum Gaming, Wyoming tribes voiced concerns that online gambling would cannibalize their brick-and-mortar properties.

Indiana

- HB 1432, sponsored by Rep. Ethan Manning

After running into opposition, including cannibalization concerns, Indiana’s annual effort to legalize online casino gambling (and online lottery sales) once again came up short. One glimmer of hope as we look ahead to 2026 is the passage of a bill prohibiting online lottery couriers, with Rep. Manning saying the goal is to allow the state lottery to start on equal footing when online lottery is legalized.

Hawaii

Separate versions of a mobile sports betting bill passed the House and Senate, with the details now being hashed out by a conference committee. The state’s online casino bills failed to gain any support.