Tax Hike Proposal May Be Looming For Online Gambling In New Jersey

The outgoing governor’s final address is coming on Feb. 25

3 min

With less than two weeks to go before New Jersey Gov. Phil Murphy’s fiscal year 2026 budget address in Trenton, his aides already are signaling that Murphy intends to make his final such address a legacy of responsible spending.

But a structural deficit of $2.1 billion in the last budget is estimated to increase to $3.8 billion starting in July unless there are major cuts in spending or increases in taxes. Annual spending in New Jersey has risen by 61% during the course of Murphy’s two terms, from $34.7 billion to $56.6 billion.

Responsible spending watchdogs have hailed Murphy’s increases in funding the state’s pension program, an inevitable long-term cost that at times has been pushed into future years for political reasons.

Still, difficult decisions will have to be made before Murphy signs the annual budget into law by June 30 following negotiations between the Democratic governor and a Democratic Party-controlled legislature.

Many state workers already are scheduled for a freeze in salaries in the coming fiscal year, and some agencies are being instructed to reduce their budgets by 5%.

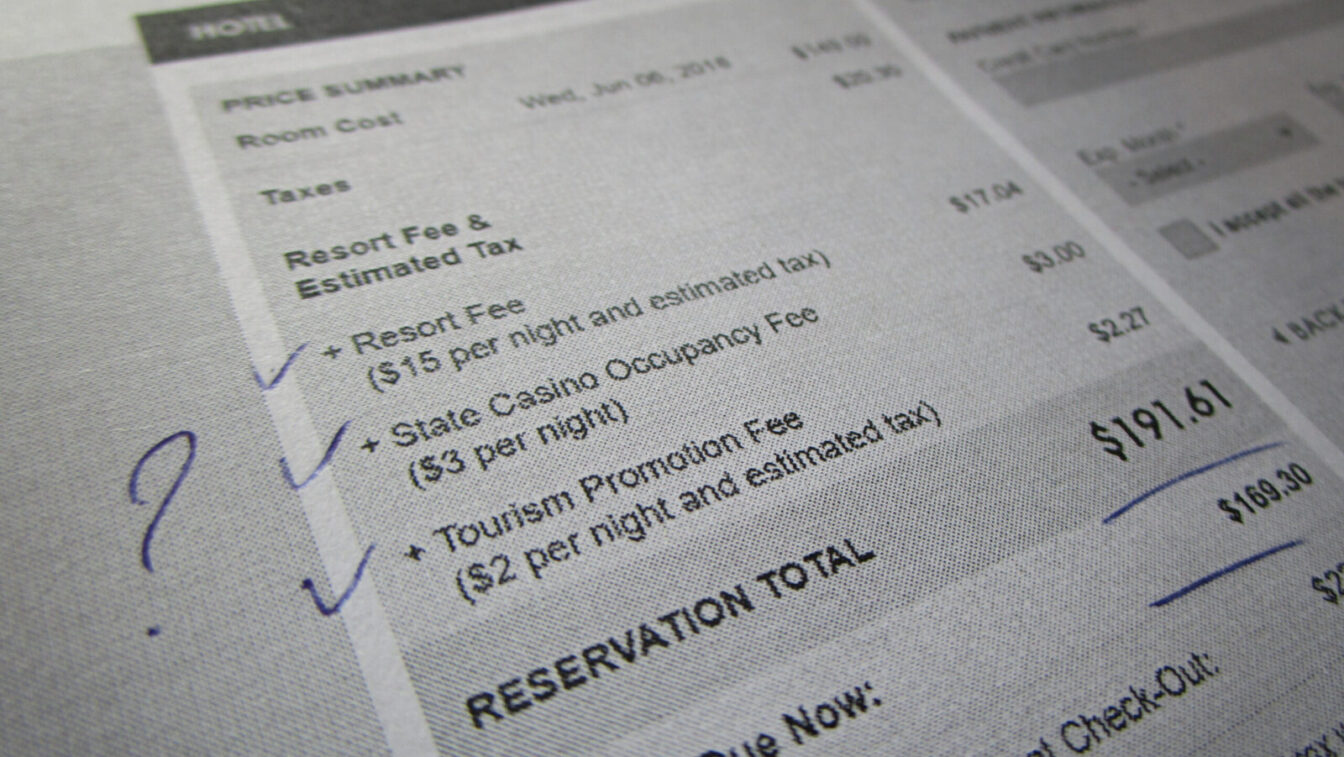

But how else can the deficit be addressed? In various reports, Murphy is said to be mulling a boost in the tax rate for online gaming revenue — currently at 13% for mobile sports betting and 15% for online casino gaming.

In 2024, online casino gaming operations produced $358.3 million in tax revenue, while online sports betting raised $138.3 million and Atlantic City’s nine brick-and-mortar casino operations generated $180.1 million (at a tax rate of 8%).

The unattributed sources raising the specter of tax rate hikes do not include a possible rise in the retail casino tax, which has not seriously been discussed for a possible rise since Gov. Jim McGreevey suggested it more than 20 years ago.

The casinos are the largest employer in South Jersey, and local lawmakers at the time railed against the proposal by citing concerns that a change in tax rate could lead to job losses and possibly even the closure of one or more of the city’s casinos.

The shuttering of five such casinos from 2012 to 2014 then cemented the concept in state politics that tinkering with those businesses’s profit margins is not a realistic idea.

But while retail casinos date back to the opening of Resorts in 1978, there is far less history with online gambling in the state. The first online casino gaming operators launched in late 2013, and legal sportsbooks did not debut until mid-2018 (after New Jersey won a protracted six-year legal battle with a U.S. Supreme Court ruling nullifying a 26-year-old federal law that had given Nevada a virtual monopoly on wagering on sporting events).

Possible ripple effects

Neighboring New York and Pennsylvania feature mobile sports betting tax rates that are double to triple what New Jersey charges, and Pennsylvania also taxes online casino gaming at more than double what Garden State lawmakers impose on their businesses.

But the half-billion in taxes raised from online gambling in 2024 doesn’t automatically rise to $1 billion if, for example, the tax rates were doubled to 30%.

As with any industry, a tax hike inevitably leads to fewer promotions, fewer incentives, and a less desirable experience for consumers. A drop in “free bets” and other promotions likely would lower the total amount wagered, and thus the amount of taxes raised.

Beyond that, the appealing low-tax environment in New Jersey has led to an influx of thousands of jobs as both online casino gaming operators and mobile sportsbooks set up shop in the state. For example, BetMGM, a leader in online gambling, now has a corporate office in Jersey City with 1,500 employees — the majority of whom live in and pay taxes in North Jersey.

A significant rise in tax rates could lead to a loss of such jobs to states with better or similar tax charges.

Last year, state Sen. Jack McKeon, a Democrat, introduced a bill to double the tax rate on both forms of online gambling. While it has languished in committee ever since, a pitch by Murphy on Feb. 25 to raise those rates could jumpstart the idea in both the state Senate and Assembly.

Ohio Gov. Mike DeWine floated a similar proposal for the sports betting tax rate in his recent budget address, only one year after Ohio’s rate was doubled from 10% to 20%. DeWine’s plan would raise the rate to 40%, an idea that some Ohio lawmakers have met with significant doubts.

“We’ve not even finished two football seasons, and now we’re talking about quadrupling that tax?” Ohio Rep. Brian Stewart told Cleveland.com. “I don’t think anything’s dead on arrival, but I do think that any time you’re talking about tax increases in the Republican Party, that’s going to get a skeptical eyebrow raise.”

Meanwhile, New Jersey’s national reputation as a pioneer in so many things gambling — from retail casinos, to mobile wagering, to being home to the world’s preeminent harness racing site at the Meadowlands Racetrack — means that the online gaming industry as a whole likely will be keeping an eye on Murphy’s upcoming budget address.

If the state follows through on a rise in taxes, then many of the 43 states that have yet to legalize online casino gaming may look to New Jersey as a guide in establishing its own tax rates in the future.