FULL HOUSE Act Fails Unanimous Consent In Senate

Unanimous consent was required to advance bill to repeal contentious tax on gambling losses

2 min

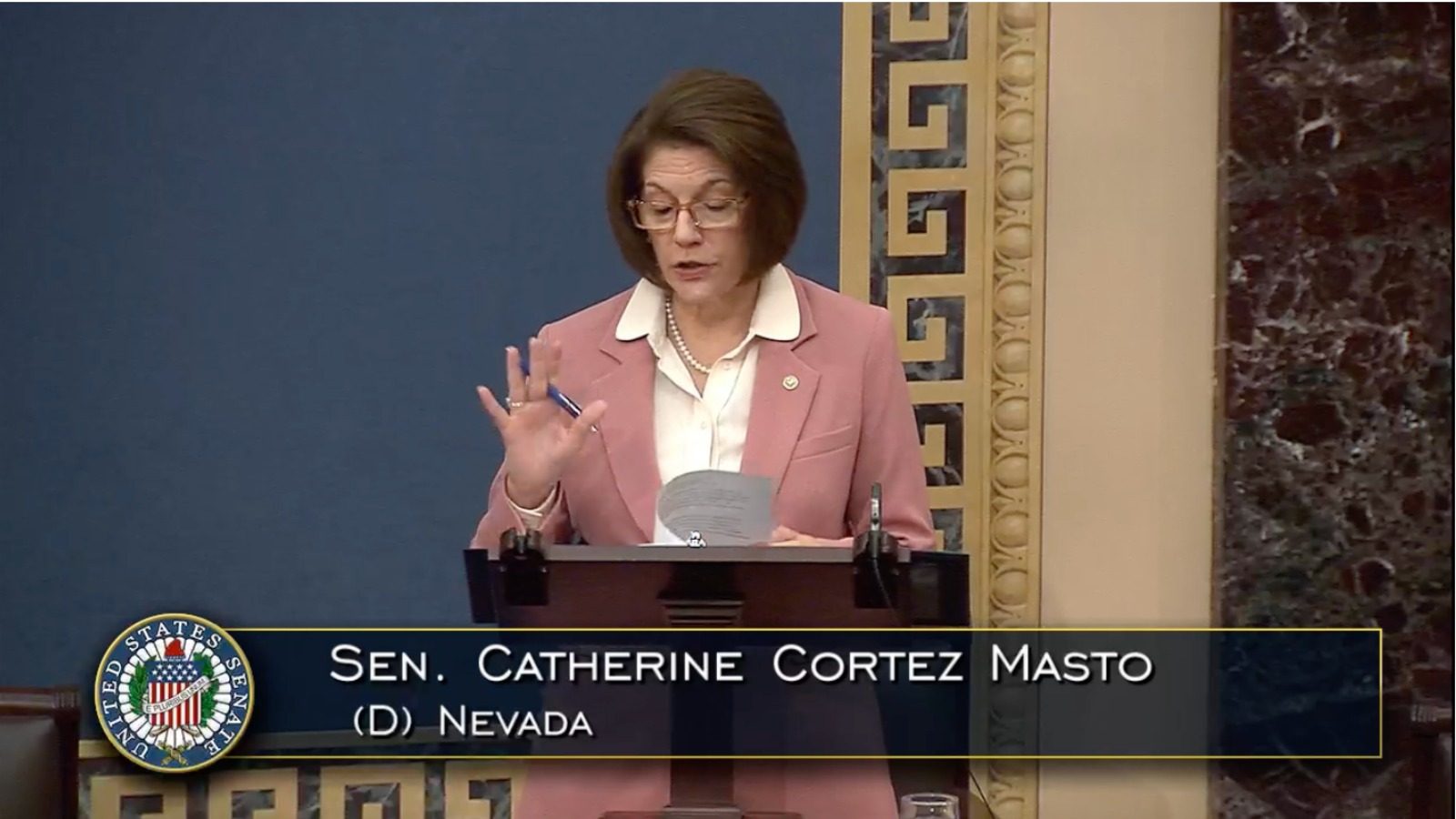

The attempt on the Senate floor Thursday to advance by unanimous consent the FULL HOUSE Act, formally Senate Bill S.2230, did not go through.

Nevada Sen. Catherine Cortez Masto brought the bill to the floor for a unanimous consent vote, meaning the bill skipped the formal process of being heard by the Finance Committee, and floor readings, going directly to a Senate vote. In this method, any one senator’s objection can cancel the bill — and at least one senator did object.

The bill was introduced in response to a gambling provision put into President Donald Trump’s tax and spending bill, “One Big Beautiful Bill Act” (OBBBA), passed by the GOP majority in the House last Thursday and signed by the president the next day, July 4.

The provision states that gamblers can only deduct 90% of their losses rather than the status quo 100%, which means that for some bettors, their tax bill could end up larger than their net winnings.

“They’d literally be paying taxes on money they don’t have. This makes no sense, and it will do irreparable harm to our country’s gaming industry if it takes effect, especially in Nevada,” Cortez Masto said in introducing her bill Thursday.

Indiana Sen. Todd Young objected to the bill as presented and requested amendments to include religious provisions also mentioned in the OBBBA. As Cortez Masto did not accept the amendments, the vote did not happen. The bill has now been assigned to the Finance Committee, and if it moves, will go through usual channels.

Why was gambling in the OBBBA?

The OBBBA was mainly focused on tax cuts, Medicaid funding, food stamp spending, and border security funding, allowing many lesser known items — including the gambling tax — to slip through.

Many Republican lawmakers seemed surprised to hear about the gambling provision after voting through the OBBBA.

“If you’re asking me how it got in there, no, I don’t know,” Republican Sen. Chuck Grassley said to HuffPost Tuesday. Fellow Republican Sen. John Cornyn said, “I don’t know anything about it. I’m not sure what it does.”

During discussion Thursday, Democratic Sen. Ron Wyden bashed Republican lawmakers for the bill and for poor process.

“In a lot of cases, they were just half-baked, poorly written. And now, I see Republican senators walking all over the Capitol saying they didn’t even know anything about this policy and this process,” Wyden said. “When you rush a process like this, this way, cram in all of these policies that you haven’t really thought about, you risk some consequences for people back home.”

Cortez Masto also mentioned the confusion among Republicans, which may be due to President Trump’s pressure on GOP lawmakers to push the bill through by July 4.

“This provision being included in that tax bill was a result of Republicans haphazardly inventing new budget rules to ramp their debt-busting bill through Congress,” Cortez Masto said. “These new rules they made up forced them to make changes to existing policy, even if it made that policy worse for Americans — and that’s what happened here.”

Backlash to the tax provision

The tax on gambling losses has the potential to drive professional gamblers offshore or to unregulated gambling operators that do not follow state regulations. This would ultimately cost individual states tax dollars.

“Combine this with the deep cuts in state funding and states will be looking to find revenue from increased gaming operator taxes (which squeeze the consumer),” professional gambler Captain Jack Andrews wrote on X. “I say this sincerely: This will implode the entire gaming industry.”

Nevada Rep. Dina Titus proposed on Monday a similar bill in the House, the FAIR BET Act, to repeal the provision. A hearing is not yet scheduled, and the bill has been assigned to the House Ways and Means Committee.

“The failure of the Senate’s unanimous consent measure is not surprising. The Senate got us into this mess and it’s now time for both chambers to unite behind my bipartisan FAIR BET Act to ensure that average and high-stakes gamblers do not pay taxes on money they never won,” Titus posted on X.